Community Update 8 - February 2024

Hello again folks! Last time I wrote one of these was back in June 2023 announcing the launch of everything. With the sheer number of announcements and releases over the last few months, I didn’t think it necessary to write another one of these, but Shaun told me to, and I do what I’m told (occasionally).

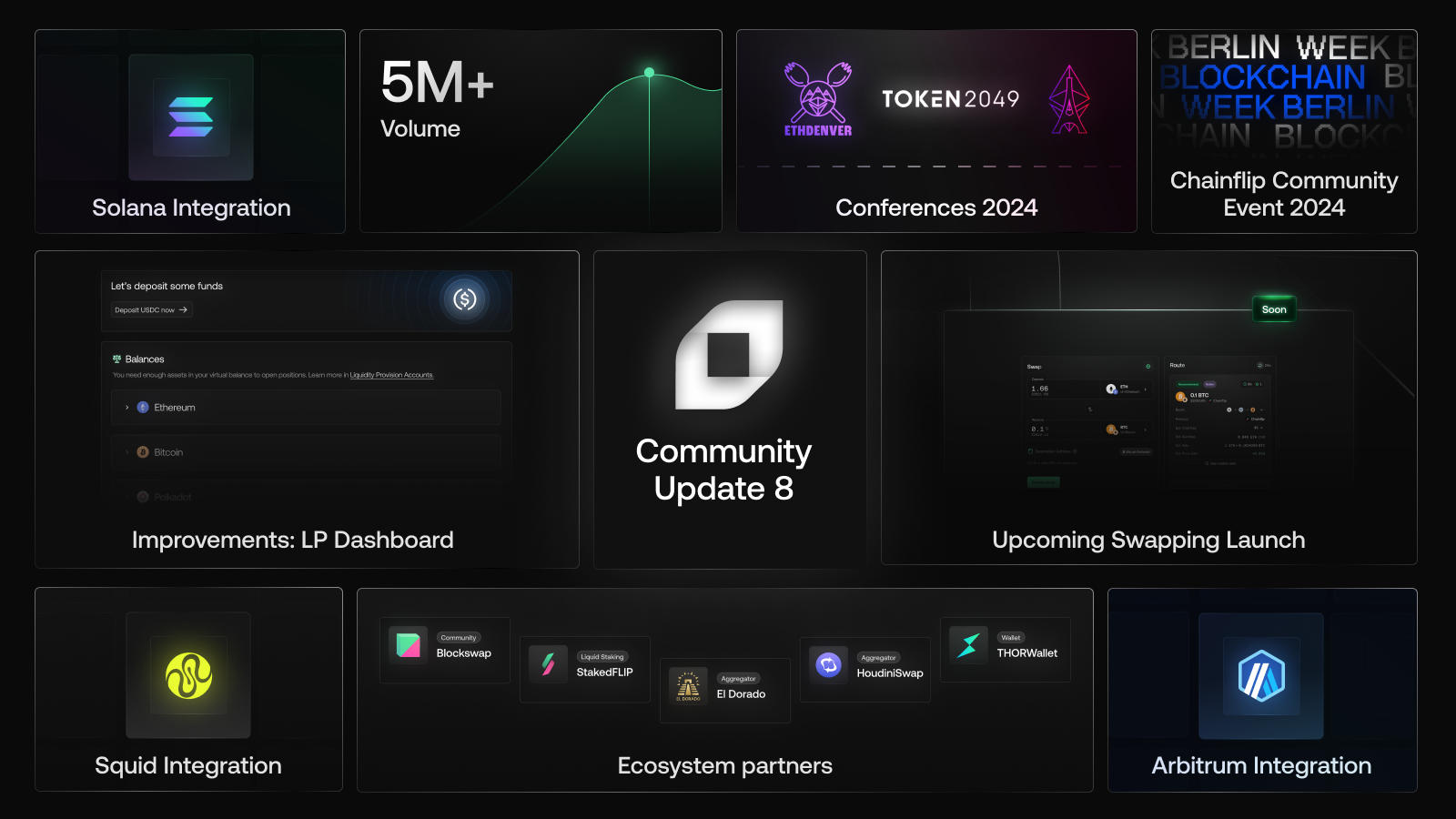

And you know what? On reflection, there sure is a lot to talk about! Aside from the obvious Token Launch, Mainnet Launch, Swapping Pre-Release and the imminent Swapping Launch, there’s been some changes here at Chainflip Labs and some future work being lined up for the protocol that I thought it would be cool to share, as well as some things you may have missed through the chaos.

Starting at the headlines though, the launches have gone swimmingly.

Headline Achievements:

- After an admittedly less-than-stellar Coinlist sale, the FLIP token hit the markets and has been sitting comfortably around the $500m FDV mark ever since.

- We launched swaps in pre-release, and have processed over $6m in organic swaps over the Chainflip Protocol over the pre-release period.

- Compared to the wildness of the Perseverance testnet days gone by, the number of issues encountered on mainnet has been exceptionally low.

- Our protocol market makers are reporting profitability even with these dainty daily volume numbers, meaning the incentives to provide liquidity are already there and should only increase over time, resulting in better pricing on bigger swaps sooner rather than later.

- Swap rates have consistently outperformed other protocols within the swap limits. Chainflip is quite consistently the best place to buy FLIP, BTC, and DOT on any DEX, with barely $100k of liquidity deployed in each pool at any given time.

- We have a string of partnership announcements (so far including Squid THORWallet HoudiniSwap, El Dorado and Subwallet) which will give us the desired levels of daily volume (aiming for $15m+ per day) within just a few weeks as we de-restrict the protocol and open the floodgates.

What's Coming Up:

In addition, we have a range of new features being actively developed which will further enhance the competitiveness of the protocol:

- Arbitrum support is built but under testing, and will mean cheaper cross-protocol bridging, which will make sense once you see the Squid integration happening on our frontend. The swapping possibilities will be epic, and the gas costs will be low.

- Solana support is well underway. We’re not far off getting a working version on localnets to begin testing the implementation. We’ll get our programs audited and will also support Cross Chain Messaging.

- We’re implementing swap protection features which will prevent swappers from getting rekt if LPs run out of a particular asset by delaying the swap until the LPs replenish their accounts and place orders again.

- A new order type - Fill or Kill - is coming. More on that later.

- A very special unannounced feature that is going to shock the universe to its very core is also well underway.

Getting all these releases out is going to be a slog, but our tactical release squad will ensure those operations are executed with the utmost precision. I can’t imagine that they won’t all be done in the first half of this year.

Updates from Around the Labs:

Protocol Team:

In the past 6 months, we completely overhauled the witnessing code, leading to improved stability. Because we make fewer assumptions about external chains, this also allows for easier integration of new assets. This new witnessing code and other changes were reviewed and audited by an external auditor, “Zellic”.

We are about to release version 1.2 of the protocol. This update includes:

- Improvements to the LP and Broker APIs: Types and names are more consistent, new endpoints allow monitoring of incoming swaps and the overall state of the order pool

- More efficient Bitcoin transactions, allowing for lower fees: By using some more “taproot” features, vault transactions now use around 30% less gas.

- Some preparations to allow for an easier release and upgrade process going forward: APIs and the chainflip engine should be more forward/backward compatible, giving operators more time to update.

- More detailed events, providing additional information for a richer UI

We started development of various new features already mentioned, and are planning to complete this development soon and then start integration of more chains going forward. Our plan is to continue to add more control over swaps, for example by adding new order types and making network and transaction fees more transparent and predictable.

Product Team:

There’s HEAPS coming from the product side, including a new LP explorer (so we can all see what those guys are up to in more detail), Tokenomics explorer, upgrades to the LP and Swap interfaces, a Broker explorer so we can see which interfaces are winning the most volume on Chainflip, unifying the apps, and lots lots more.

We’ve also been busy helping a lot of external integrators get stuck into swapping on Chainflip in preparation for the upcoming Swapping Launch.

Ecosystem Team:

After quietly launching a small grant program to give integrators some incentives and KPIs to hit, we’ve had a flurry of announcements come out with some great results so far. Our launch partners are quickly stacking up and we’re gearing up to enter the market with some of the best pricing available on BTC and ETH swaps.

There’s more announcements to come, and plenty of discussions underway to secure more integrations on an ongoing basis after the official launch has come and gone.

In particular, we are focusing mainly on integrators that already have BTC support, as the case for Chainflip integration is quite clear-cut. Second is those with large user bases that do not yet have BTC support (and using that as an in). Finally, there are also dozens of other ways to get Chainflip selected as a route in many protocols through third-party integrations (Squid being a great example). It is our goal to have no less than 10 individual aggregators, wallets, and other interfaces using Chainflip by the end of the first half of the year. We are well on track.

Will and our latest recruit Irena have been doing a fantastic job at managing the vast majority of external relations activities for the company - big shoutout to those two.

Marketing & Community:

Finally, on the marketing and community side, we are preparing our campaign for the upcoming launch which will ring in the end of the main launch sequence, and the beginning of an ever-maturing, ever-growing protocol. This will entail introducing more of our partners into the ecosystem, and showcasing to the community more about what we have been organising in the background.

We’ve been talking to the press a bit, a bunch of people on Twitter, and of course, working hard to put together some new activities for users to participate in, whether that be on chain swapping competitions, or content to get the community more engaged in learning how Chainflip functions We feel quite strongly that the product is an easy sell once truly de-restricted, and are thinking about what we can do to promote each of the new upgrades to the relevant communities that they impact as we go along.

There’s also some merch stuff happening real soon. Soon the Chainflip cult will have a uniform that you’ll have the chance to get your hands on.

The community has gone from strength to strength, with tons of new tools, bots, members, and chats happening all the time. A big shoutout to David Cumps and Rama Aditya, two of our leading community members at the moment, who have really helped us develop this amazing community into what it is today.

Upcoming Events:

Big news: We’ll be running a Chainflip Community event in Berlin during Berlin Blockchain Week (mid-late May). We may also perform a live DJ AMA event with community members as a live audience! Book your flights.

Furthermore, you’ll also find at least one of us at:

- Eth Denver

- Crypto Assets Summit (London)

- Token 2049 Dubai

- Berlin Blockchain Week

- Probably EthCC Brussels

- And probably several more throughout the year!

On the CEO’s Desk:

So with the key information finally out of the way, I can now indulge in some fluff.

Personnel

As a first note, it became pretty immediately apparent that we would need more hands on deck after the token launch. As such, we brought on a handful of new folks in engineering, finance, and ecosystem development roles. I’m a big believer in lean teams, but these people do truly bring unique skills to the table which I am very keen on exploiting.

Aside from these new additions, little has changed in the team since my last update. It is a true honour to grow and learn hand in hand with this squad, whose experience and capabilities accelerate with each passing week. I can’t think of a single person on the team who didn't contribute some essential skills to the various launches we’ve gone through in the last few months. Long may it continue!

Funding

We’ve received a lot of good funding over the years, but after building Chainflip over the last 3.5 years with a full staff and contractor complement now reaching about 35 people across multiple countries, and a lot of our free capital now tied up in liquidity operations, we’re in the process of raising a modest amount of capital to deal with increased operational costs, new initiatives, and additional liquidity provision. We’re still working the details out, but expect to see a funding announcement come out in the near future. Lockups will apply, and the tokens sold will be offset in the treasury by Validator operations in the Chainflip Group.

That way, should any market shocks come, we’ll be as resilient as ever, and still capable of building and developing the protocol at this elevated pace.

Personal Update

While all of this has been going on, I've been very fortunate to get out to the southern hemisphere for the last couple of months. Running the swapping pre-release from my Mum’s house in Australia over Christmas was quite interesting with the timezones. However it did mean I was able to keep an eye on things while the rest of the team slept in the opening weeks. Lately however, I’ve been working from my other home away from home, Cape Town, South Africa, for the last few weeks.